an Order book is a topic frequently discussed among traders. What is an order book? Is it a vital tool to get a picture of the market or just a small help? Can an order book be a foundation for your trading strategy? Is the data gained from an order book relevant? All these questions will be answered in our article.

What is an order book?

An order book is nothing complicated. It‘s a “mere” list showing the sell or buy orders used to record the interest of buyers or sellers. One should realize that not all orders are fulfilled at the current price level called market price. The market also includes waiting for orders. These are fulfilled at the selected price level (rate) but some of them are never fulfilled. Anyway, they all end up in an order book.

The above picture illustrates a typical order book. It is a snapshot of the Bitfinex platform showing buy and sell orders in a column as well as prices, totals, amounts, and counts.

Explanation the data order book shows

The order book on Bitfinex pages is divided into two basic halves: buy orders and sell orders. Buy orders are on the left (green) half and the sell orders on the right. What do the lines and columns mean? Let’s explain them.

- Price: Price is simply the rate at which the order is set. If someone buying bitcoin sets the price at 6 500, his order will not be fulfilled until the market reaches this level. It will stay sitting in the order book and wait until someone is willing to sell the number of bitcoins at this price.

- Count: is a number of individual orders waiting for the given price. In our case, once the market gets to the price of USD 6 394, theoretically 17 sales will be made (if there is a willing buyer).

- Amount: is a total of all orders for a given price. So, 17 orders, whose total value is BTC 12.4, are waiting on the price of USD6 394. For the price to go up traders at the exchange must buy all the bitcoins.

- Total: is the total of all orders ranging from the current price to the price determined for a given line. You can read from the picture that should the price climb up to USD 6 400 the total of all purchases would have to amount to BTC 63.9.

In our example, we used bitcoin. However, the order book is used not only for cryptocurrencies. It is a thing that is being used by all marketplaces incl. stock exchanges.

Types of orders

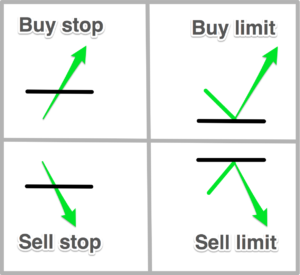

Let’s have an example: The current exchange rate of your favorite asset is 1.1. You wish to sell at 1.2 (e.g. the 1,18 level shows a strong resistance level and you expect that after being broken the price will grow). Because the current rate is 1.1 and you are not going to stay online nonstop you will enter buy stop. Once the rate reaches your desired level (i.e. 1.2) the buy order will be fulfilled.

Otherwise (rate remaining at 1.1 but you want to buy at 1.0), you will enter buy limit.

Naturally, it works vice versa, too. You can enter sell stop and sell limit orders. These orders are above or below the current price. The following picture will help you in orientation.

There are 4 types of trading orders you can use:

How to use order book

An order book should be offered by every broker. A simple table or chart shows where waiting orders are entered and whether the sentiment is bullish or bearish, in other words, whether the trend in the market is upward or downward. Logically, the dominance of sell signals indicates decline and vice versa. However, be cautious, an order book doesn’t show future market orders (fulfilled at the market price). All you see is data of a given broker.

An order book is visible to all traders including big institutional players which may result in many false signals. It is wise to have all orders from your order book confirmed by using technical or fundamental tools. In the past, a lot of orders in the order books was nearing a level monitored by a central bank. As an example you can use CHF/EUR at 1.2 or CZK /EUR at 27. These rates were attentively watched and one could see huge amounts of orders waiting at level of 1.18 and 26.8 respectively. Once the interventions were lifted, the market kicked off.

Data relevance

And now the key question: Is it enough to watch the order book, derive the key levels and confirm them by using a simple technical analysis and start trading? The answer is: Yes and no. The data (acquired either from your broker or exchange) represent a small fragment of the market.

The data does not give you the full picture of the market. It might be misleading. The bigger the broker, the more accurate the data. What matters is not quantity but quality, in other words the representativeness of your data sample. A lot of brokers do offer fairly representative samples.

It’s up to you to decide which way to go. The fact is that the data taken from an order book reflect a small fragment of all market players. On the other hand, the data should cover the basic types of trading habits of the majority of retail traders, which may give you an interesting picture. If you combine the order book with the technical or fundamental analysis you may get a trading strategy that works, which is the fundament of trading.