Glossary Of Terms From The World Of Binary Options

Submitting documents (identity verification)

In order to be able to withdraw money from your trading account, a commission CySEC that regulates all brokers (basically all brokers that can be found on our list of binary options brokers) requires documents confirming their identity.

The documents are following:

- Picture of an ID

- Picture of Gas, electricity, phone bill or a bank statement

- Picture of the credit card (with your details covered)

This practise is quite common and there is no need to be afraid. The reason is that every trader needs to be 18 years or older and to make a deposit, a card with the same name needs to be used.

The picture of an invoice or a bank statement is required in order to confirm your address.

FCA

Financial Conduct Authority (Used to be called FSA) is a regulatory body that controls financial services in the UK and takes care of the stability of the financial sector as well as the customer’s safety.

Deposit bonuses

Bonus is the value that a trader can obtain extra to his first deposit. The greater the initial deposit, the bigger the bonus is offered by brokers. Bonuses differ from broker to broker, but most are between 20% – 100%. Every bonus has to be wagered in order to be withdrawn, so it’s basically NOT free money as some might think.

Bonus wagering

The word wager means “to make trades in value” and can be found in articles and terms and conditions about bonuses. When a brokers offer a bonus, you always have to make trades in x-times the value of the bonus in ordet to be able to withdraw it – wager.

Let’s say that a broker gives you a bonus, i.e.: $100 and if the wagering requirement is 30X, you have to place trades for at least $3000, in order to withdraw the bonus, but that’ll be quite easy with all our advice.

A pip

A pip is the smallest possible movement that an asset can make, whether it’s up or down. If the price of EUR/USD is 1.33610 and it changes to 1.33611, it means that it’s moved by 1 pip. However, not all assets have 5 decimals. For example USD/JPY usually has 2 decimals, so a movement of 0.01 would mean a change by1 pip.

In the case of binary options, all we need to know is that if the price, in the expiration time, is higher or lower by one single pip that you’ve predicted then the trade is considered successful or in-the-money. That’s all it takes for your trade to be profitable

Expiration time

Expiration time is a period or time at which the options expire or we evaluate whether the trade has been successful or in other words in-the-money. Expiration times usually range from 30 seconds to couple of hours, but some brokers offer trading for longer periods of time (ie. months).

The longer the expiration time, the easier we can predict the development of the market, however this rule usually applies to the expiration times under a week.

Strike price

Strike price(initial price, buying price, opening price) is the value of an asset (index, stock, commody or currency pair) at the beginning of the trade, just when the trade is opened. Expiration price is the opposite.

Forex

Forex is an abbreviation for Foreign Exchange. It’s a trade with foreign currencies, for example USD/EUR. Of course, there are many more, so it’s important with what trader you are collaborating, because not everyone offers all of them.

Brief history of Forex

Trade as such has been part of the mankind for a very long time. Before we started to use money as a currency, trading has been done in a form of an exchange, therefore trading goods directly. With the inventions of money as a currency there has also been a need to change different currencies – in the past, it has been precious metal(silver and gold) as a method for currency conversion. Since 1971, FOREX is used as a way of trading currency pairs.

Forex as such, is not an institution with a proper building like a classic stock market. It is “only” a worldwide connected computer web, where millions of traders can see a 24-hour course development of individual currency pairs.

A SCAM

We can consider a scam certain brokers that are not trustworthy and might cheat their customers, for example: zoomtrader. A scam can also be called a website that offer immense and absurd numbers, attracts you with super cars, houses and beautiful women. Yuck!

You can find some reviews of binary options scams on this website.

An asset

An Asset or an instrument is basically what we trade with – it can be gold, silver, Facebook stocks or currency pairs EUR/USD. Some brokers (Olymp Trade or IQ Option) offer more than 1000 assets to be traded.

Drawdown

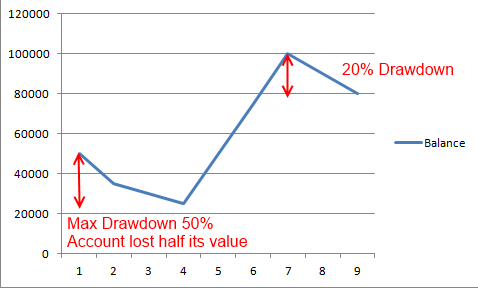

In the world of trading, drawdown means the biggest decline of your capital. So, if you’ve made 100 trades for $10, out of which 80 finished in-money and the other 20 were somehow spread in the 80, the maximum drawdown will follow at the end of the largest series of lost trades, i.e.: if out of the 20, 6 were in a row, the maximum drawdown was $60.

The graph shows the sample amount of capital (vertical) to the number of months spent trading (horizontal). We can see that we, in the beginning, have suffered a 50% drawdown, from which we’ve recovered and at the end of the trade we’ve experienced another decline of 20%. Therefore the biggest decline was 25 000.

Breakeven ratio

Breakeven ratio is a percentage number that indicates how many trades are to be won in order to achieve long-term profit. With binary options brokers with a profit of 80% (average profit), it’s about 56% – this means that if your long-term profit of all your trades is going to be more then 56% with the same amount, you’ll be making a lot of money and losing none.

CySEC

CySec (Cyprus Securities and Exchange Commission) is a regulatory authority from Cyprus. It ensure that investment firms(brokers) adhere to strict laws and regulations.

CySEC duties include:

- Supervising and controlling licensed investment services companies

- Carrying out inspections over brokers and brokerage firms.

- Granting operational licences to investment firms

CySEC official website can be found here: CySEC.

Price action

Price action is a type of technical analysis and is based on the price movement. The difference between price action and technical analysis is that you don’t use any additional indicators when trading price actions. An example of price action trading is using trend lines or support and resistance trading.

Timeframe

Graph’s time frame; position traders will use, for example, day charts where one candle represents the change of a price in one day. This is called daily time frame.

Intra-day traders use an intra-day time frame, for example M15 (1 candle=15 minutes) or M5.