Are you a beginner or an intermediate trader looking for the right mode to help you achieve your goal? Then, you are in the right place. Let’s take a look at a few tips to help you in taking the first steps. Start up your trading career in the right direction no matter what your current job is.

When to trade

The timing of your trades depends purely on you. The market is open for 24 hours a day for 5 days a week. Forex trading is available any time. The time for trading cryptocurrencies is even more favorable; you can trade even on Saturdays and Sundays including instruments such as binary options, CFD contracts, or buying cryptocurrencies. If you ask if it is better to trade in the morning or in the evening, one thing that may help you to answer this question is the trading sessions. The biggest difference is in volatility, trading volumes and fundamental factors.

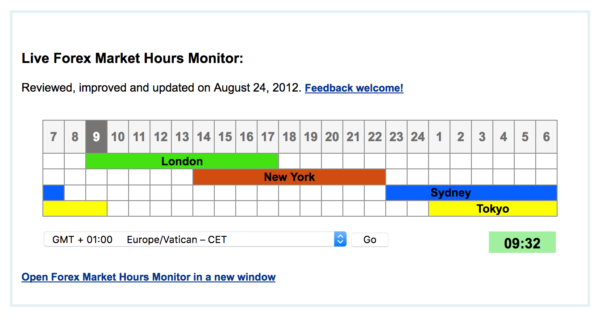

To enable trading in a 24 hours/5 days regime the main trading centers in the world open differently depending on the geographical zone. One can easily deduce that the demand for trading some pairs such as EUR/AUD will be much lower when people in Europe sleep (as opposed to Australia). The same case is EUR/USD whose volatility significantly declines outside the hours in which the European and US trading centers are open.

Trading sessions:

- London: 9:00–17:00 (CEST)

- New York: 14:00–22:00 (CEST)

- Sydney: 23:00–7:00 (CEST)

- Tokyo: 1:00–9:00 (CEST)

The best time for trading, let’s say, EUR/USD is from 9 am to 10 pm. As to the Australian dollar, we recommend time from 2 p.m. to 7 a.m. A similar recommendation applies to other currencies. I recommend you read the website ForexMarketHours, showing the centers and timing of trading sessions.

How many trades to realize

How much time shall I spend on trading? The answer to this question varies individual by individual. If you work as a full-time employee I recommend that you spend on trading one or two hours a day. To rest and relax is essential; don’t underrate it. Forex trading is a stressful activity. To cope with the psychological stress you need enough sleep and relaxation. The fact that Forex markets are closed over weekends might be one of the advantages in this respect, for even the hard-core workaholics have to take a break.

If you dedicate one or two hours to trading each day you should also get ready for days on which no trading signal occurs when all you will be doing is to sit in front of your PC passively watching the screen. It depends to a certain extent on your trading strategy, but even the best forex trading strategy does not guarantee a series of trades each day. Days of no activity are a natural part of trading. Remember, quantity is not your goal; what matters is quality. If you experience days with no trading order don’t despair. Hardened full-time traders know that this is happening from time to time. To enter a trade compromising your trading strategy out of lack of patience would be a huge mistake.

Watching your trades

The importance of setting the stop loss order (a price level at which a losing trade will automatically close) has been discussed many times before. The same level of importance applies to setting the take profit order (the opposite to stop loss i.e. a price level at which a winning trade will automatically close). If you have already set the two orders you can switch off your PC and be sure that your trades are well-protected.

If I am too busy to watch an open trade all the time I check, usually by phone, what’s happening in one-hour or two-hour intervals (depending on the trading timeframe).

How to eliminate the risk

There is plenty of guides and rules how to manage risks in proportion to your trading account. It’s recommended that the risk should not exceed 2% per trade or 5 % of your total trading account. Consult your trading strategy, figure out the value of a pip and choose the right volume in lots to live up to this rule.

90% of success in forex trading depends on discipline. Many people are not patient and enter a trading signal prematurely using intuition rather than a trading strategy. Another frequent mistake is the absence of stop-loss orders. Some major reasons why most people suffer losses are mentioned in this article: Seven reasons why traders keep loosing money.

Losses are part of trading. Anticipating losses is what you were doing when testing your skills on historical data. Losses come and go. There is nothing that bad about it. Stick to the rule never move a stop loss, always strictly follow your trading strategy and as a beginner avoid risking more than 2 % per trade and 5 % of your total trading account. These rules are rigid but lead to success.

How many times can I trade in 24 hours or a day??? What’s the maximum amount can be earnd in a day? Will you please tell me?

Hello! I have been practicing on my demo account via the Olympic trade app. But my confusion is that the platform or (page) displayed on my screen is different from the one displayed when I log in via website. Would you please help me understand their difference because there are options I see on one but not on the other.

Dear Sarah, the platform of OlympTrade will always look a bit different on your computer and on your cell phone. There’s no need to worry, as long as it’s possible to access it from both devices with the same credientals, it should be alright.