Are you asking what and when to trade? The answer may be simpler than it sounds. The answer largely depends on the timing of your trade. So, what indicators to use, what currency pairs and assets to focus on? We have already touched this in our article Trading psychology: how often to trade and how to manage your trades, but repetition is the mother of learning, isn’t it?

Trading sessions

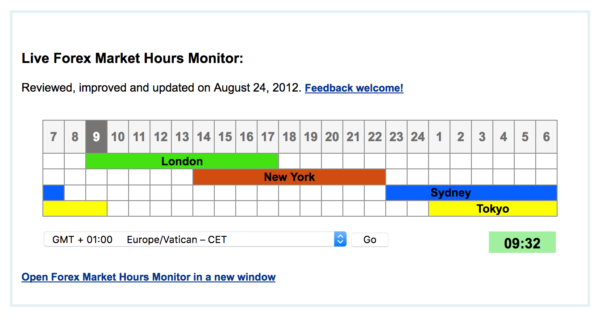

Trading sessions are the fundament. The Forex market is open for 24 hours a day, five days a week. Cryptocurrency market is open for 24 hours a day, each day in the week. Markets in which shares are traded are always open based on the stock exchange’s opening hours. To make it possible the main trading centers in the world open differently depending on the geographical zone (from Europe to Australia and Asia). The most famous financial centers include London, New York, Sydney, and Tokyo.

Timing of trading sessions:

- London: 9:00–17:00 (CEST)

- New York: 14:00–22:00 (CEST)

- Sydney: 23:00–7:00 (CEST)

- Tokyo: 1:00–9:00 (CEST)

Nothing is fixed. Although you are a European you can participate in trading sessions in Asia or Australia. Logically, the majority of European full-time traders copies the European session. The reason is simple: When do you think the currency pair EUR/USD will be traded most? During the crossing of the European and American sessions or, at least during one of them.

Notice that after 10 pm the trading activity of the above currency pair significantly declines. It’s because Australian and Asian traders are interested in other currencies than EUR and USD. I recommend the website ForexMarketHours to see when each session takes place.

How to use trading sessions

Depending on your favorite or chosen currency pair or another asset you can assess when the pair is likely to be more or less volatile and make use of it in your trading. You can also look to the past session, which may set the direction. Many European traders in the morning before they start their work analyze the Asia trading session. Important indicators (such as Fibonacci) play a major role in it suggesting what might be the reaction during the European trading session.

The second option is the concept of initial balance, usually the first hour of a new session that is supposed to indicate in which direction the market will move. We may draw a parallel with a standard business day. If you know that your day is going to be busy you will get up early in the morning and work quickly. If your day is supposed to be less hectic you are inclined to have a slower start.

Though not being a living thing, market behaves similarly and the first hour may suggest what the next pace might be. More, you may apply Fibonacci lines, or trade for bouncing or breaking the initial balance (high and low in the first hour). These simple facts can be used for building a strong Forex trading strategy. Initial Balance is one of a few indicators than are suitable for the strategy BERSI Scalp.

It is useful to know something about trading sessions and benefit from this knowledge to gain profit. Although not being the Holy Grail, trading sessions can serve as a good helper.