If you want to do trading and are you serious about it you must have a trading strategy. It’s not enough to have the strategy in your head it must be on paper with a fixed set of rules. Today, we will explain what such a trading strategy must (should) contain and how to make it be one of the minorities of successful traders. You will also learn a few practical tips.

The idea behind the trading strategy

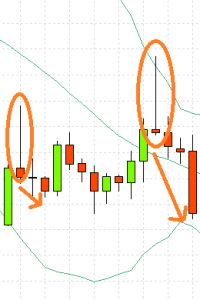

This may seem like a paradox to identify a trading strategy or an idea based on which you can do your trading is the easiest thing. As a trader you can use trend lines, indicators (e.g. MACD, RSI or moving average. Reliable are also pinbars or other candlestick formations.

Another successful Forex strategy is gap trading. The number of opportunities is incalculable. To start with, I recommend something simple, trivial. From my practice, I know that even the simplest Forex strategy may have a success rate of 60%.

This is not enough for the majority of traders. The trading strategy is usually complicated by further indicators. In the end, the strategy is so complicated that it becomes useless or even loss-making. Many people believe that Forex and trading, in general, is a rocket science but mostly the strength is in its simplicity.

Backtest

Once you have identified your trading strategy, you must define a timeframe for your trading (this topic was discussed in one of our previous articles – see types of Forex traders). You also must choose the market, in which you want to do your trading. A quality sales strategy is robust and can be applied to currency pairs such as EUR/USD, EUR/JPY, gold or DAX. Yet, each market has its specifics: The speed, volatility and pip price are different. So it pays off to step into a market you are familiar with at least from a demo account.

Next, you have two options: (1) to program an order to run a Forex backtest right in the platform or (2) manually go through at least 100 trades back (on the platform’s data). Even though you are able to program the backtest, manual testing with the help of Excel will give you more. You will far better learn about the strategy and how to find it immediately. It’s simple: Using a chart, look into history to trace back the formation.

However, you must also anticipate that some strategies will redraw. Be careful and test the strategy also at meta trader strategy tester!

Trading strategy rules

The core of each trading strategy is the rules. You must set where to place the stop loss and where the take profit. Although this depends on the volatility of the market, rules are a must. For example, the backtest shows that after opening a trade the profit will be 20 pips and the stop loss 30 pips. Given the success rate of 50%, this deal would be a loss.

The above example demonstrates that there is no universal setting.

The rate of 1:1 will be seen by some traders as success while others will want two successes out of three deals. Someone will not be satisfied unless reaching a 50% level. No matter which way you go, it always depends on the stop loss vs. take profit orders. Another factor that you must not underestimate is psychology. Only few people are mentally so strong to use a strategy generating loss in most of the trades (but overall profitable).

What you need is efficient money management. Nevertheless, talking about binary options and Forex, money management is applied in a bit different manner.

Trading plan

Based on the backtest result and your evaluation you should know exactly which market you would like to trade in and what timeframe would fit you (day, 4 hours, 1 hour, 30 minutes…). You should also specify the conditions for closing a deal, estimated profit and maximum acceptable loss. These parameters are essential for each of you and should be put on paper (not just stay in your mind).

After you have prepared the strategy, you can start trading with small volumes and amounts of money so that in case of loss the impact would not be so painful. And as usual, I recommend you should first test your skills on a demo account, for example with IQ Option, or plus500 offering the demo account free of charge.

Proven Forex brokers

| Broker | Trading Instruments | Leverage | Spread | Review | Open Account |

|---|---|---|---|---|---|

| | Forex, CFD, Crypto, Shares, Commodities, Indices | Up to 1:30 | From 2 pips (depends on asset) | Review | Trade Now! |

If you strictly stick to your trading strategy Forex will not surprise you. Then you are on the good track to becoming a successful (fulltime) trader. Good luck!