In our previous part and numerous articles at our website, we have described how to design an effective trading strategy. Let’s look for some inspiration! I will show you techniques that you can completely take over or use to improve your current trading strategy by filtering loss-making trades.

Trend vs. sideways movement

The first fundamental question is “Will my strategy work when trading with or against the trend?”

- Trend trading is more tempting as it offers bigger gains. Many traders find this way of trading as “more natural”. The next step is to decide whether one should trade with the trend or against.

- Sideways trading is more typical because the market moves in the same direction. RSI or Stochastic represent two of many indicators in sideways trading.

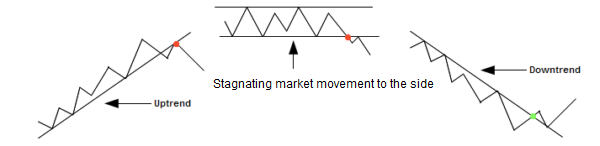

It’s up to you to decide which way to go. However, there is one thing you must know: Is the market in trend or is not. As you can guess, trend strategies will only work in trend and vice versa.

Phases of market movements

Bollinger Bands and Moving Averages

The indicator is known as “Bollinger bands” uses as a base MA (moving average). In this combination, each indicator has a different meaning. If you use a moving average, let’s say with a period of 50, you will see the present trend. The situation in which moving average is going down and the prices in the chart are below the moving average represents a downward trend. MA going up with the market above the moving average line indicates an upward trend.

Determining a trend by using the above rule can also be applied as a filter for other trading trend and non-trend strategies If you trade in daily or weekly cycles you will need a longer period such as 200. Traders holding a position for a couple of seconds and minutes will do with 30.

Opening of trade: Bounce from MA in a downtrend market.

By adding Bollinger bands to the moving average you can create a simple trading strategy. Bollinger bands show when the market “takes a rest” moving sideways. At this moment, the instrument tends to get closer to the middle band of the Bollinger bands to react. You can speculate that after a minor retracement the trend will continue.

Modification of trading strategy

Got an idea and trading plan? Now it’s up to you to carry on. You have been shown the fundaments of a trading strategy but the most relevant factors for your success are the instrument, time band and, most importantly, position management. Position management is the very fundament on which other things are built.

Option 1: When opening a position you can place the stop loss and take profit orders on the upper and lower Bollinger bands. Option 2: To leave the stop loss and take profit orders floating at the level of the newly created Bollinger bands. Option 3: Open with an X volume and close only a half (i.e. X/2) of the position at the level of Bollinger band (in profit), to continue working with the second half (to move stop loss to open position and to use take profit for speculations over the formation of a trend or, to set floating stop loss at the level of Y pips from the top profit).

Further information on how to work with the stop loss / take profit orders can be found in our articles, category: Forex money management.

The idea of using Bollinger bands as a core of your trading strategy is the easier part. More difficult is to correctly set up the strategy, which requires a thorough test. Give yourself a whole day (can be one over a weekend), look at a chart showing history, draw a few indicators in it and perform a back-test. This procedure is universally applicable to Forex, commodities, shares as well as binary options. To develop a Forex trading strategy takes a few hours. No pain, no gain. Performing the back-test will help you better understand the strategy.

Those who expect from this article a concrete strategy should not ignore the fact that markets evolve and that it is necessary, from time to time, to adjust the stop loss and take profit orders. If your ambition is to be a serious trader you will (using the above advice) surely find your own trading style. We will appreciate if you share with us your achievements and ideas for improvement in our comments section.