You surely know this typical principle: You buy a thing in one place at a low price and sell it in a different place which offers a higher price to earn some profit. The difference between the low and the high prices can be cleverly exploited at various crypto-exchanges where the prices typically differ. Let’s see how this works.

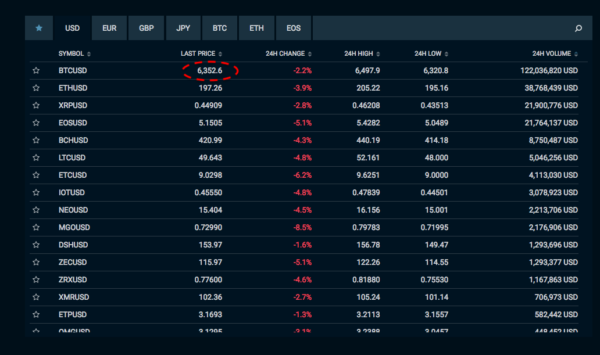

You will best understand the arbitration principle by showing you the following example:

Risks of cryptocurrency arbitration

Obviously, the above example is a simplification ignoring some hypothetical risks. Let’s take a look at the factors that may influence our chances to win a profit through crypto arbitration.

- Fee: The first thing you should be careful about is a fee, charges. A transaction fee may trim your profit massively especially when the difference in price of a coin or a token at various exchanges is not sufficiently big or when you are exchanging a small number of coins.

- Transaction duration:You face a serious risk also if the transactions between the chosen exchanges take too long and the price of the coin under arbitration dramatically changes during the process.

- Exchange error: In early 2018, Binance made an error. The displayed price of one of the coins was a multiple of its real value. This provoked people to massive purchases driving the price of the coin far above the prices offered by other exchanges. This triggered an avalanche. People believed that now they can go to other exchanges to buy at a low price and then return to Binance to sell at a high price. Everybody would buy and transfer. Meanwhile, Binance noticed the error and stopped all withdrawals using the controversial token. The coins were frozen and didn’t allow the traders to sell or transfer. Before the situation was resolved, the coin had lost tens of percent of its value.

- Money on account: A quick transaction doesn’t necessarily mean that it’s OK. The exchange itself may slow down the process because of some extra time in needs to confirm your transaction and credit to your account. In the meantime, the price may change and your attempt to sell at a high price may fail.

- Fiat currency deposit: If your deposit on the exchange is low it makes no sense to attempt arbitration. The time you will need for transferring the fiat currency to the exchange may take a few days. Remember “Luck is what happens when preparation meets opportunity“. If you have your account with Fio bank, you can go to CoinBase to make a purchase within a few minutes.

- Low demand: Another risk factor is the trading volume of a particular coin at a particular exchange. It may happen that you will not be able to sell all your coins bought at a low price somewhere else to be able to achieve some profit

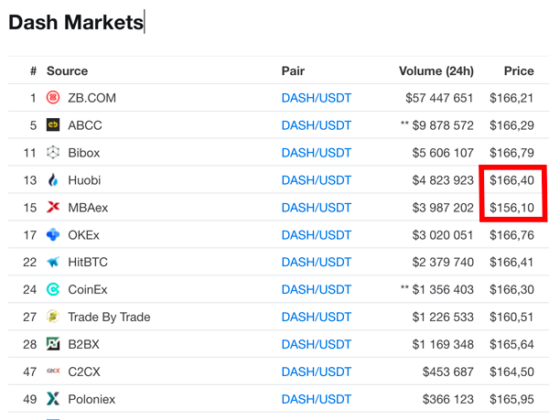

- Reliability of exchange: You may suffer a loss after choosing a non-trustworthy or non-liquid exchange. Low prices may indicate thon the exchange is a dubious business. Not wanting to leave too much money with an exchange, people may be lured by their „bargain offerings ”.

How to avoid the risks: Considering arbitration, choose cryptocurrencies whose transactions are quick and fees minimal. This may be for example LTC or XLM. Make sure that the coin you want to use is popular enough to avoid problems when selling it.

Different prices of Dash offered by Huobi and MBAex. Attention: The big difference may indicate problems of MBAex!

Benefits

While various speculations may damage the market, arbitration may be beneficial. The prices at different exchanges should not vary too much. Arbitration should make sure that they reach a comparable level. There is plenty of people carrying out arbitration on a daily basis. By buying at one exchange and selling at another the prices achieve balance.

It’s not necessary to control the arbitration process manually by clicking item by item. There are lots of programmed bots performing some parts of the process in an automated manner such as the identification of relevant opportunities for arbitration across the exchanges as done by ArbitrationBot or ArbMatrix from the Coinigy trading platform.

Does arbitration pay off?

If you have some extra cash and are willing to take the risk that you may lose it don’t hesitate. Set yourself some rules and stick to the rules to minimize the above risks. Get your bitcoins ready at multiple exchanges and, when needed, exchange them for a different coin that fits for arbitration (but make sure that you can trade this coin on an exchange on the opposite side).

The arbitration may generate decent profit and, if you love the excitement of risking, it will surely add more spice to your trading routine. If you want to make a profit by arbitration you will need enough experience. A lack of experience may result, at least initially, in a few losses. Be prepared to manage it!

Example of arbitration: different prices on two exchanges