Let’s stop with theory and start trading. If you have managed to read the guide to cfd trading up to this point you deserve some bonus. This bonus includes two free Forex trading strategies. You can use them for trading instantly. Let’s go ahead.

Before we start, let me stress that the fact that I use these strategies myself does not necessarily mean that they will fit other people, too. All people are different and traders are no exception. They prefer different things, different strategies, different money management plans etc. I recommend you test more than just one strategy to find out whether you like this or that but, most importantly, to see how much profit you are able to earn.

Gap trading

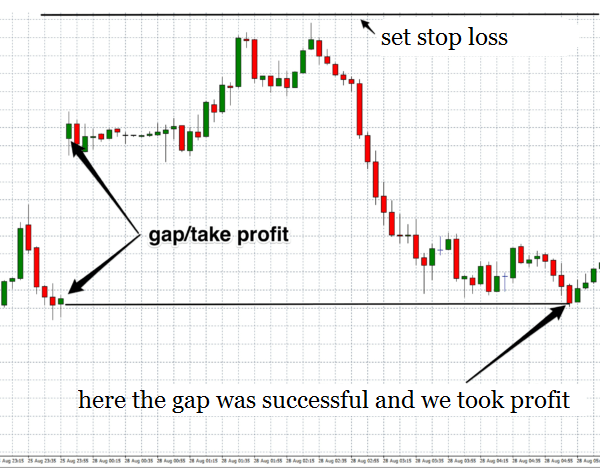

Have you noticed that sometimes over the weekend, a gap occurs on the Forex chart? In other words: Monday trading does not continue from the same point where it closed on the last Friday? The gap between Friday’s closing value and Monday’s opening value is called a gap. A lot of traders including myself see this as an opportunity.

You can open a trade, but always place your take profit at the end of the gap to let the price fill the gap. I set stop loss at 10 pips in the opposite direction regardless of the size of the gap. Albeit primitive, it works.

Every trade should by nature be suspicious. Instead of believing me, you should sit over a chart and test it on 100 trades in a row. Create an Excel spreadsheet and write down all data in it. For more details about keeping a trading diary, read: on trading diary .

Test, let’s say, stop loss vs. take profit at the ratio of 1:1 (depending on the size of the gap). Experiment with a stop loss for 20 or 30 pips. Since each trader should apply some analytic thinking, I think that this forex strategy the way I wrote it is at least a good starting platform.

1-2-3 gap

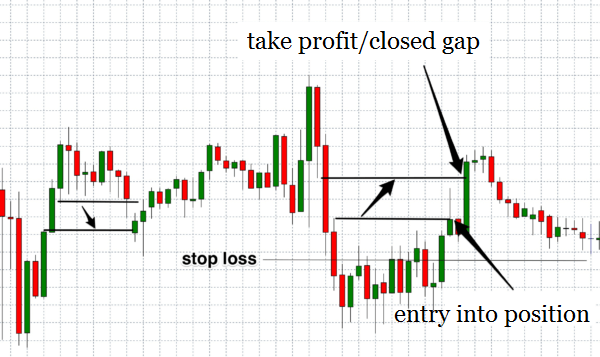

I will show you one more trading strategy so that you don’t have to wait a whole week for a single trade. This strategy is based on a similar principle as the one above but it involves the usage of support and resistance. (More about support and resistance) The underlying idea is as follows: If three candlesticks in a row make a gap between the first candlestick’s high and the last candlestick’s low (or in the opposite direction) the market will try to fill the gap. The below pictures show this situation more illustratively.

The idea is simple: wait until the market returns to the given zone and then profit from filling a gap. Take profit is the whole gap again and what about stop loss? I personally set the take profit ratio in this case (on a 30M EUR/USD chart) as 1:1. As a stop loss you can set the formation’s high (i.e. high/low of the first or last candlestick) or you can set fixed values such as 20, 30 or different number of pips.

Instead of blindly believing, you should test it all. Test “stop loss” keeping in mind that we are different, have different timing expectations, different trading ambitions. This was discussed in an article titled What type of trader would you like to be?

Test the above ideas. Forex market does not believe anybody. Do the same! Don’t believe and test on a demo account to see whether it makes sense or not.

Forex brokers offering demo account free of charge

| Broker | Trading Instruments | Leverage | Spread | Review | Open Account |

|---|---|---|---|---|---|

| | Forex, CFD, Crypto, Shares, Commodities, Indices | Up to 1:30 | From 2 pips (depends on asset) | Review | Trade Now! |