Does it make sense to use fundamental analysis for trading cryptocurrencies? Is such an analysis reliable enough? Sure, it is. Otherwise, we wouldn’t spend so much time on it in our series dedicated specifically to this topic. You also may ask what are the specifics of trading cryptocurrencies as well as the risks.

Fundamental analysis has its pros and cons.

Pros: The good news is that cryptocurrencies tend to react to various political and economic news the way you would expect from them: the good news are usually followed by growth, bad news by decline. This makes the environment much more transparent for trading than in the trading of Forex fiat currencies. Another advantage of cryptocurrencies compared with dollar or euro is the lower capitalization (as transfers smaller than billions of euro or dollars are reflected in the price).

Cons: If everything was so simple as described above fundamental analysis would be used by all traders. This, however, is not happening. Why?

The advantage of the traditional Forex trading in this respect is the existence of established periodical news aggregators not enabled by cryptocurrencies. In cryptocurrencies, it is the opposite. There are no established official news aggregators and therefore important news about cryptocurrencies appear unexpectedly. This makes each trader to continuously follow news about every cryptocurrency because each project publishes information at its own discretion.

Monitoring news about cryptocurrencies

How to keep up to date on cryptocurrencies? We recommend the combination of two methods. See our practical demonstration below.

Crypto-broker (exchange) info channels

The first option to follow the news about cryptocurrencies is to use various information channels used by cryptocurrency brokers and crypto-exchanges, obviously as long as you trade with them. Their advantage, as opposed to large stock exchanges, is their limited currency portfolio. Using a single information resource will help you get more in-depth and detailed information.

Alternatively, you can make use of social networks such as Facebook or Twitter or some less common communication tools such as Telegram or Slack. One shouldn’t ignore RSS websites, blogs, and various discussion forums, either. The official website of each cryptocurrency should always serve as a reliable indicator and, at the same time, a relevant resource of information. Using the mix of all the mentioned resources, you will be up to date about all innovations regarding individual currencies and ready to adequately react.

News portals

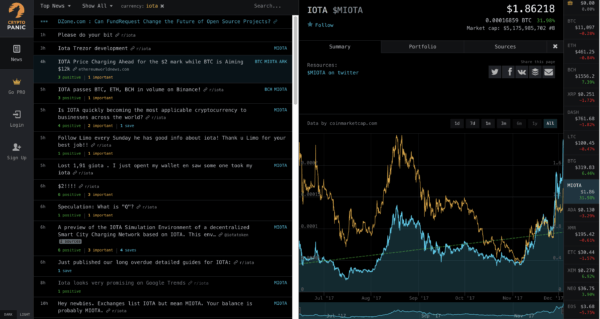

News portals are a good option primarily for traders using services of large portfolio exchanges i.e. portals such as Coindesk, my favorite CryptoPanic or Cointelegraph, publishing more relevant news. This is exactly the type of news that is useful for traders whose portfolio isn’t defined rigidly and focuses on what is covered in the latest news. The portals are a great choice for traders to select the best currency for trading.

The main shortcoming is the absence of a news portal to provide the traders with all essential news in time. As far as fiat currencies are concerned, this portal exists. Professional services in this field are offered for instance by Reuters.

Combination of broker info channels and news portals

It’s always good to look at both sides when crossing the road. The same applies to listening to the news. To watch both official and unofficial channels pays off. Additionally, it’s smart to be in a picture by not ignoring some of the hearsay news appearing on the websites. A good approach is to define a certain area of cryptocurrencies and to continuously keep up with the latest trends and developments.

Initially, shoot with blank ammunition.

The best proof of each theory is its practical application. However, this practical application might end up in heavy losses of your hard-earned money. To avoid it happening, we recommend you first study all reports in detail and when you go hunting for the first time use blank ammunition, in other words, test your strategy on a demo account.

Trading cryptocurrencies via a demo-account are available with IQ Option. The latter offers to trade of most popular cryptocurrencies (bitcoin, litecoin or ripple) both via demo and real (live) accounts. You can start from as low as USD 10 by sending the amount to your account by card, bank transfer or electronic wallet (e.g. Skrill).

Get registered with IQ Option

| Broker | Bonus | Min Deposit | Payout | Review | Open Account |

|---|