Martingale is a popular strategy for gambling with the likelihood of success of 1 to1 (such as red vs. black on a roulette wheel). After losing a round, you should double your bet which should make up for the loss in the previous rounds plus generate some profit. The question is clear: Does this approach work in trading, too?

Martingale is a popular strategy for gambling with the likelihood of success of 1 to1 (such as red vs. black on a roulette wheel). After losing a round, you should double your bet which should make up for the loss in the previous rounds plus generate some profit. The question is clear: Does this approach work in trading, too?

The trading plan is a holy grail

A trading plan is a holy thing. This is nothing new and you must have read it in our articles many times. In terms of long-term profitability, we agree. What about putting conventional trading aside for a while and looking at the martingale trading strategy?

We have already analyzed this strategy from the binary options trader’s point of view. The problem we must tackle now is somewhat different. Therefore we recommend you continue to read. If you want to know more about martingale from the binary options’ perspective read the following article: Martingale with binary options.

Martingale and trading: trading strategy

First of all, you need a trading strategy, similar to those used for betting in casinos i.e. offering a success rate 1 to 1. In terms of trading, this means two things: the strategy must be successful at least at 50 % and the risk-reward ratio must be the same or close to this figure i.e. the take profit and stop loss ratio should be around 1 to 1.

Under these circumstances, the strategy will be similar to those used in a gambling hall where you bet on red or black and odd or even.

The question of whether martingale can work is being discussed at various forums. As a long-term trader promoting serious trading, I would answer that it cannot. Perhaps I shouldn’t be so rigid. Martingale is a trading strategy too, not a mere gamble, is it?

Martingale: opportunities and threats

If you are an owner of an efficient trading strategy you have the following options: (1) Find a broker offering trading without leverage or, (2) carefully figure out the amount of cash that you need. Why? Try to think about the sequence of doubling your “bets”: 1, 2, 4, 8, 16, 32, 64, 128, 256, 512, 1 024, 2 048 etc. If you are a trader you know this very well. Sometimes you experience a series of losses. With martingale and in the case of leverage trading, the risk grows exponentially. So, you must answer the following questions: Can I afford it? Is my trading account big enough? Am I willing to take such a risk?

Martingale is a strategy for extremely aggressive traders. On the other hand, why not? Why not to try out this strategy? Open a forex demo account and make a test. If you achieve good results, in the long run, open a real trading account, ideally a micro-account with a few tens or hundreds of dollars on it and with a minimal (ideally none) leverage and go for it.

Martingale as a trading strategy

There are basically three ways of how martingale can be used in trading.

Increasing trading volumes

This simply means that if the first of your trades in a series is a loss (1 lot, loss of 10 pips) you will do your next trade with 2 lots (the same loss of 10 pips). Leverage has no impact on this method.

Increasing leverage

This simply means that if the first of your trades is a loss of 1 lot, 10 pips with a leverage of 1 to 10 you will do your next trade with the same amount i.e. 1 lot and 10 pips. The problem is that not all brokers enable an easy setup and adjustment of leverage.

Extending the distance between the points for stop loss and take profit

This simply means that if the first of your trades is a loss of 1 lot, 10 pips with a leverage of 1 to 10 you will do your next trade with the same amount i.e. 1 lot but double the distance between the stop-loss and take-profit points. In our case, this will be 20 pips. Leverage has no impact on this method. The disadvantage of the strategy is that after a few losses in a row the distance between the stop loss and take-profit points will be too big that it may take hours, days or even weeks for your lines to be hit, which will cost you plenty of money spent on fees.

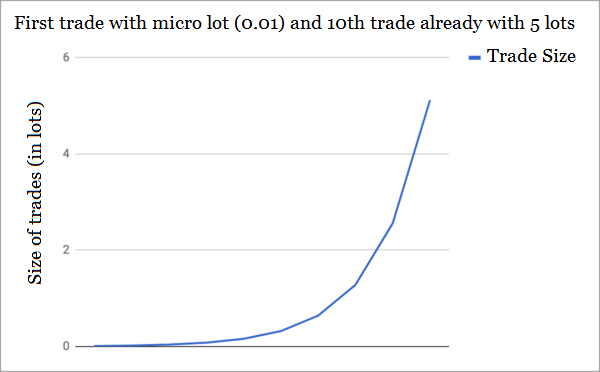

The picture on the right-hand side shows how quickly the volumes of individual trades grow in the case of suffering a long series of losses. This example applies to the above-described method, increasing trading volumes.

If you start trading with a micro lot your 8th trade in a row would amount to 1 lot and the 11th trade would exceed 10 lots. This surely is not a sustainable strategy.

Eventually, you may find out that martingale is a very complex trading strategy which has fixed rules for stop loss, take profit, use of leverage and trading volumes. Naturally, you can voluntarily combine these methods. In combination with another strategy this may no longer be a mere gambling strategy but a robust trading system.

In spite of what was said above we do not recommend martingale as your main trading strategy. It’s rather an idea that can be elaborated on or used separately with a small account. Anyway, if I were a beginner I would start with a more conservative strategy.

As already mentioned, I have always been sceptical when it comes to this topic. If somebody asked me whether I recommend this strategy my immediate answer would be NO. After thinking about it in more depth considering the integration of some rules I am inclined to admit that it makes sense. Anyway, this is not any trivial trading but advanced management of positions. Be extremely cautious when using this strategy

Are you TRADING without profits?

Are your STRATEGIES obsolete?

Are you unable to predict market correctly?

Have you lost your investments through your trading platform and you are actually not the one that placed the trades yourself?

Is the fund in your trading account depreciating without your authorization?

Are you unable to withdraw your money from your BROKER ACCOUNT?

NOTE: If one of these questions are for you, then am here to provide you solution; not only that i can help you with STRATEGIES that works in this current economic meltdown. But i can also teach you how you can recover all your LOST MONEY, make WITHDRAWAL from your TRADING ACCOUNT successfully and recover the lost funds you didn’t trade and loos by yourself withing 24hours; have you heard about binary ADMIN SECRET CODE? that is what you can use to stop BINARY TRADE BROKER’S from manipulating your trading account, get back to me so i can tell you the importance.

You seem like that you are really experienced and that you can help everybody with his problem. We will see if someone will respond you 😉