A fork is a term which describes a situation in which a blockchain of the original currency is split into two incompatible branches. An existing currency gives birth to a new one. The reason behind a fork is most frequently the community’s aspiration to set different rules. This may include:

- reduction of the crypto’s mining potential,

- adjustment of the technical parameters of a transaction (the first bitcoin hard fork),

- effort to recover damage caused by cyber attack (reverse fork of Ethereum after stealing tens of millions of USD),

- attempt to invite a multinational to impose regulation.

Split from an original currency can be done by anybody. All that needs to be done is to download a relevant code (in case of Bitcoin you will find it on GitHub platform) and to adjust the blockchain. If the author of the new crypto succeeds in persuading a large group of users to mine and perform transactions there is a chance that the new currency will take root.

Hard fork versus soft fork: What are the differences

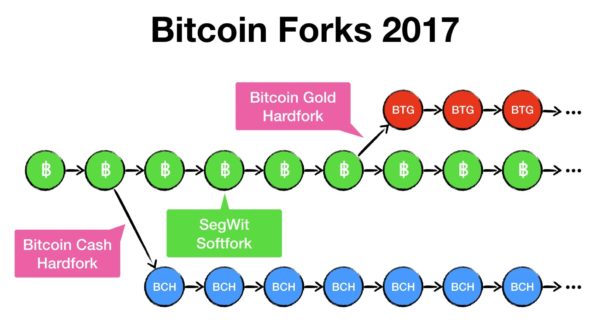

There is always some amount of new coins created by permanently splitting from the original cryptocurrency. This is called a hard fork and works on a principle of copying the original blockchain while introducing new transaction conditions. Both blockchains (of the new and the old crypto) share the history and co-exist one next to the other independently.

Due to similarities between the two currencies, transactions performed with one blockchain are usually “recorded” in the other one. In theory, a recipient of one crypto might receive an identical amount of the other crypto. Replay protection is a tool to protect you from such actions. It includes replay and verification of a transaction. If the transfer does not comply with the new crypto’s transaction policy the transaction will be invalidated.

Soft fork, a change to the crypto protocol, is an inseparable part of the existence of cryptocurrencies. Soft forks occur in order to validate newly mined blocks from an old piece of software.

History of Bitcoin forks

Bitcoin, the oldest of all cryptos, has undergone two main hard forks. Along with the two, the history knows many other forks with a minimal impact (such as Bitcoin Diamond, etc.)

The first hard fork took place in August 2017 in the wake of the effort to raise the quantity of transactions during the verification process. As to bitcoin, the size is limited at 1 MB. The software verifies on average three transactions per second. With the growing number of transfers the average time continues to grow as do the costs. People who want to get a quick service must pay the miners for computing capacity.

The new Bitcoin Cash (BCH) performs 8 times more transactions per second than the old one. On the other hand, it is not as much trusted as its older brother. While the value of bitcoin in mid-February 2018 was USD 10 340, Bitcoin Cash was traded at a price 7 times lower.

The second fork of Bitcoin Gold (BTG) pursues the original idea of creating a decentralized currency. This is a response to the continuing concentration of mining in the hands of a few large pools. As of 18 February 2018, the value of BTG was USD 135.87.

Impact on the end user

A split of a cryptocurrency does not mean that you will lose your digital money. After copying the blockchain you still remain the owner of a cryptographic key to your wallet. Unless you use third-party applications the new currencies allow you making transactions.

After a hard fork, all owners of the original currency get the same amount of the new currency. This, however, does not mean that the value of the currencies you hold has doubled. As you can see, the exchange rate of BCH and BTG is 7 times resp. 76 times lower.