Let’s start with the breaking news (…which, to be honest, surprised me).

Apple bans binary options!

A change worth mentioning is the ban imposed by Apple on trading binary options. Starting from this month you will not be allowed to download any app offering binary options trading onto your iPhone or iPad (Source: Finance magnates)

Interesting change, isn’t it?

Apple defends the step by receiving complaints from its clients arguing that the apps generate fraud tarnishing Apple’s reputation.

If I were in Apple’s shoes I only would ban applications offered by non-regulated brokers leaving the rest as it is. But that’s up to them.

What do you think of it? Based on my personal experience, I have never had any problems with the IQ Option app on my iPhone.

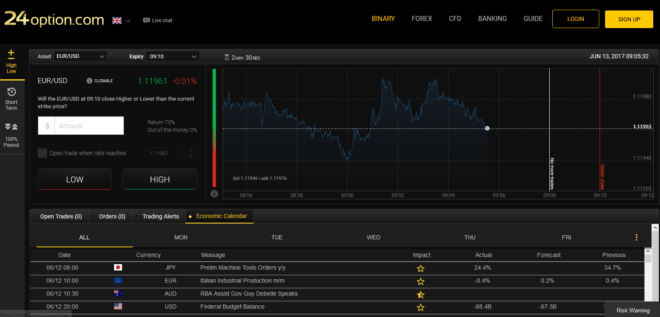

24Option comes with a new platform and products

A few months back, we heard the news about 24option coming up with a new platform. Until recently, the new platform had not been accessible to the public. A few days back this changed. The platform is now available on-line offering a number of promising changes. Let’s spend some time on it:

- 1) New platform design

– I must admit that the previous platform was awful. Comparing the platform with the one offered by IQ Option was like day and night. The difference between the old and the new platform is not so big, but the changes are obvious. I think that the new platform is a bit faster and opening trades is smoother, surely an important change for the better. - 2) Offer of spread options

– I am sure that a lot of you guys are familiar with the term spread options (more details) offered by brokers high-low and ETX Capital. Simply, these are options with 100% evaluation put in a position somewhat less advantageous for the trader (…as the strike price of these options is a few pips in the disfavor of the broker). This type of options is now on the 24 option’s portfolio. - 3)Planned opening of trade

– The new function of planning trades is something I like indeed. Thanks to this feature you can set e.g. that once the price hits your support or resistance line, a trade will open for 5 minutes in the direction of the rebound from this line. Or vice versa, if the price gets beyond the (support/resistance) line the trade will open in the direction of crossing the line.

- 4) CFD Trading

– 24Option newly offers CFD Trading. This means that from now on, next to binary options you can do CFD (forex) trading. What are the differences of this type of trading? For more details read: Binary options vs Forex. In my opinion, this is a logical change because when you look at areas under the focus of regulation it is a clever move from a broker to put such a service on the portfolio. I guess that within next 6 months more companies such as IQ Option and all other brokers with the Spot Option platform will follow the suit.

I like the fact that regulators act. Noticing new things, they strive to protect investors. Nevertheless, in my opinion they do it the other way round. Instead of complicating the very business of trading their ban should be imposed purely on the trading with non-regulated brokers. This is the core of the problem in this business.

We will see what next changes they will come up with…